(commentary)

I finally got around to reading Nikon's Annual Report in detail, and it's worth picking out a few things that are in there, as they have implications on the cameras we all use and love. In no particular order:

- As I've noted before, cameras and lenses are now 74.4% of the company's sales, something that Nikon notes early in the report. What isn't noted is that camera and lens profits exceeded the overall company profit. As I've noted before, the continued success of cameras are critical to Nikon.

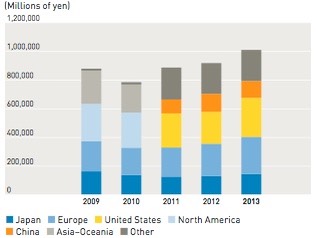

- In the up-front summary, we have three current objectives for the Imaging Division: (1) successive launching of products that are clearly differentiated in terms of technologies and marketing capabilities; (2) establish brand and secure leading positions in emerging nations; and (3) achieve 15% operating margin in the year ending March 2016. Not much happening on #1, I'm not convinced #2 is going to really provide that much of an upside (see Nikon's chart below), while #3 means a 50%+ improvement over current profitability when we're in a downturning market, which will be tough to do.

- Nikon's short-term goal is to basically grow sales 10% in the current year (ends March 2014) and increase profit by nearly 70%. However, the things that Nikon noted that deteriorated the Fiscal Year 2013 results are not only still present, but increasing.

- Here's an interesting quote: "it is essential that we grasp…how far the compact digital camera market is likely to shrink and the interchangeable lens-type digital camera market to grow." This, of course, isn't necessarily true, as facts tell us: the interchangeable lens camera market is shrinking this year. While annual reports tend to be optimistic and positive, one thing investors are noticing now is that Nikon's statements like this are increasingly in contrast to reality.

- Another telling quote: "To improve profitability, it is essential that we reduce costs." The camera market is extremely cost conscious now, and there's a ton of overhanging inventory still unsold. Thus, the statement is trickier than it at first sounds. Sure, maybe you can take some costs out of your next camera, but the problem is that current cameras are adding costs back in as you have to reduce prices. What we've seen at several camera companies lately is an increase in SG&A expense, which is where the selling at a discount costs tends to get put. Nikon's SG&A costs are about the same in the last two years, but the Cost of Sales has gone up from 61.7% of sales to 65.7% of sales. That's not good.

- And the quote that should be sending shudders throughout the investment community: "[The Imaging Company] could be considered a low-margin, high-turnover business." What Nikon intends to do about this is, yep, reduce costs. This is classic dive-to-the-bottom behavior. That's at best a delaying tactic. I do like that Kimura-san also noted "when it comes to interchangeable lens-type digital cameras, we need to question our ability to offer truly innovative functions and performance." That, actually, is the essence to getting out of a dive to the bottom: innovate and disrupt at a product level where you have strong product margin, in order to grow market share (or grow the market itself). I've always felt that Kimura-san was a fairly straight shooter and saw the camera group relatively clearly, and this statement is an example of that. Reading between all the lines, it seems likely that Nikon has recognized that the camera group can't continue to execute the same way it has in the recent past: the natural tide of a growing market is now gone, and to survive you have to duke it out with the other remaining players by doing better products, and doing them less expensively. Of course, that's just the high level plan. The real question is in the doing. I don't believe we've seen anything of what Kimura-san is suggesting yet. The longer it takes for that to happen, the more problems Nikon will have moving forward.

- Like virtually all of the Japanese consumer electronic companies, Nikon seems to see healthcare and medical-related businesses as a possible future business for them. Other than Panasonic, who recently sold most of their healthcare business to an American investment fund, and Canon who sees security cameras as the big win, everyone else in Japan seems to think medicine is their best, well, medicine. Olympus already derives most of their sales and profits from the medical business. Fujifilm and Sony are investing heavily in this area (including Sony's investment in Olympus). And now Nikon wants a piece, too. Nikon historically has only been in products that have an optical center to them. The problem at the moment is that Nikon's definition of what they're going to do in this field is nebulous, at best. As Nikon themselves say, they don't expect any tangible sales impact until their fiscal 2016 year.

- Nikon claims a 20% market share in the mirrorless market, which Nikon claims is the #2 position (Sony is likely in the top position). That's despite the fact that Nikon feels the Nikon 1 "struggled slightly" and "failed to grow to the extent that we had anticipated." This is a curious set of statements. I find it difficult to believe that Nikon thought the Nikon 1 would grow rapidly at the price points they sold it at (often higher than DSLRs). Second, the 20% share came mostly because of deep discounting of older models. See the problem?

- "We expect the market for interchangeable lens-type digital cameras to continue expanding in the fiscal year ending March 2014, with particularly strong growth in the non-reflex digital cameras [e.g. Nikon 1]." Since that statement was written, the monthly shipments of such cameras were: down, down, down. So far, that's been the trend for seven straight months with no end in sight. So we have a couple of things that are obvious: (1) Nikon does not correctly see the actual evolving market trend; (2) considering the backlog of existing cameras still in inventory, there's an implication of declining product margins, at best case. (Nikon claims that "we were able to realign [inventory] performance to plan," but I suspect that's a statement made at the corporate level, not at the subsidiary level.) Nikon's plan here is: "focus on sales of high-margin new digital SLR cameras…reduce manufacturing costs." Well, at least they're consistent in what they're saying. However, given the QA issues with the D800 and D600, reducing costs had better be done with care: additional missteps like those will not be seen by the user base in a favorable light.

- Nikon's DSLR market share target: 40-45%. Nikon's mirrorless market share target: 25-30%. Nikon's compact camera market share target: 25-30%. (All by March 2016.)

- Advertising expenses were up about 11% year-to-year. Coupled with the weak overall sales, this seems to indicate that the friction of making a sale is going up.

- All the negative news aside, Nikon is still a profitable, relatively healthy company. The financial fundamentals are still well within reason, the company has a good cash flow and a reasonable cash reserve, liabilities are under control, and there are no glaring negatives in the numbers that would indicate a mortal wound. The company is experiencing a sales plateau—pretty much across the board—and has some cost issues it needs to finesse because of that. Over the past few years, Nikon has looked like a growth company. It no longer looks like one to me. So how they address finding new growth while managing parts of the business in decline will be the real story here.