(commentary)

What goes around comes around.

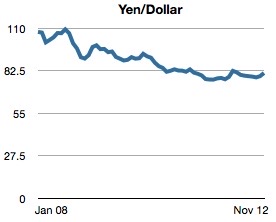

I've been checking in on the yen/dollar relationship from time to time and what it does to camera pricing in the US. If you follow the financial reports the Japanese companies release each quarter, you'll tend to find that one of the key numbers that's always up front is currency exchange contributions.

Japan these days consumes less than 10% of the cameras made, especially at the high end (DSLRs). Thus, they're all exporters. When you export, currency fluctuations are something you watch really carefully, as they have ways of killing profitability if you're not careful. Indeed, many of the Japanese companies use hedging strategies to try to "smooth" the impacts of these fluctuations.

Until mid-to-late 2012 we were in a long "yen appreciating against dollar/Euro" pattern (downhill slope in following graph). This reversed in the second half of 2012 and now we appear to have the beginning of a "yen depreciating against dollar/Euro."

So what's that mean?

Well, from the peak of the yen to the time I'm writing this, we've seen a 11% change in favor of the dollar (yen depreciating). The camera companies were all forecasting something around 80 yen to the dollar for the last quarter of 2012, but it may have averaged higher than that. Indeed, big enough that, used wisely, can be used move product via price adjustments. [Today's current rate: 88.2.]

It's no surprise that Nikon had a number of strong instant rebates and price reductions in Q4 2012 as a result: the changing wind of the currency values gave them flexibility to do so. Nikon seems to have used the softening yen as a way of increasing unit volume sales (or at least meeting their aggressive estimates in an otherwise declining market) and balancing inventories. In other words, Nikon worked at using the change to buy some market share and get the warehouse shelves emptied.

The question, of course, is what happens in 2013. We'll know shortly. Once the numbers from last quarter have firmed up in the accounting department, Nikon will make a choice. My guess is that they will continue to be aggressive, though perhaps not as aggressive as a free lens with an FX body ;~).

I should note that you can see some interesting trends in the CIPA numbers, which I think we'll also see reflected in Nikon's results when they announce them. There aren't a lot of economies in the OECD that weren't flat or in recession in the last half of 2012. China, US, Germany, Brazil, were the primary countries not in recession. The CIPA numbers show a significant shift of product shipped to the US, and I suspect it's because of two things: our economy was growing, and the yen/dollar relationship first stayed relatively stable, then swung towards the yen devaluation, which gave them pricing flexibility to move more iron.

I'm not an economist (probably a good thing considering how often they're wrong), but it does seem that the trend lines are all set for continued dollar appreciation against the yen. Given some of the statements of the new Japanese government, it seems that the Japanese policy is now tilted towards depreciating the yen (thus increasing exports).

Of course, not everything is done in yen by the Japanese companies. Nikon makes most DSLRs in Thailand, so the bhat is another currency that is important. Likewise, the Nikon 1 and Coolpix cameras tend to be made in China, so the yuan comes into play.

Still, overall, the factors look favorable at the moment for continued price aggressiveness in the US by the camera companies, especially with DSLRs and higher end gear. Our economy is growing, the currency fluctuation is favorable for Japanese exports, and we still like DSLRs over mirrorless ;~). I expect Nikon to continue to aggressively promote product in the first quarter of this year.