Nikon announced their financial results for the first half of the current fiscal year on Thursday. The basic takeaway is as before: the company remains profitable but is under pressure to find sales growth.

It’s the Imaging Products Business that you’re probably interested in, and here are the declines you’re probably expecting:

- 2.18m DSLR/N1 units down from 2.98m units last year (down 27%)

- 3.09m lens units down from 4.2m lens units last year (down 26%)

- 3.57m Coolpix down from 5.8m Coolpix last year (down 38%)

Yet operating income (profit) from those sales was down only 11%. In Nikon’s words “Operating income increased owing to improvements in cost and product mix.” Product mix is shorthand for they sold more higher end cameras with higher gross profit margins as opposed to lower end ones (remember that “just go out an buy an FX body” quote? Now you know why).

Indeed, you can see the trend even in CIPA numbers for DSLRs. In September the average selling price of a DSLR was 56,033 yen, while five months earlier it was 40,238 yen.

For the full year Nikon has revised their numbers downward for ILC units, but still expects the same Coolpix numbers:

- 4.9m DSLR/N1 (down from 5.75m), though still a 33% market share

- 6.9m lenses (down from 8.23m), a 30% market share

- 7.5m Coolpix (down from 11.16m), a 27% market share

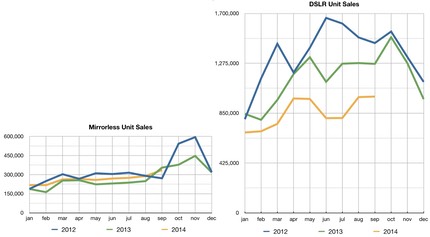

While Nikon’s maintaining market share, here’s Nikon’s basic problem in a pair of graphs (CIPA camera shipments):

Their mirrorless offering isn’t really resonating for Nikon, so they're not benefiting from the slight year-to-year growth of that category. But look at those DSLR numbers, where Nikon’s big money makers are: clear year-over-year declines. If I were to graph the Coolpix compact camera category, the problem would be worse than the right-hand graph, above, but Coolpix has always been a volume feed product. A moneymaker, sure, but on thinner margins and lower prices. It’s that DSLR segment that Nikon lives and dies by.

Nikon still expects to run a nearly 10% profit margin in the group for the year, which would indicate that they believe they have their costs reigned in and that the model mix they’ll sell will continue to shift towards the higher end.

There are things that puzzle me a bit, though. First is Nikon’s continued use of 100 yen/dollar as the estimated exchange rate going forward. That’s well off where the yen/dollar relationship currently is, and some of the big names in currency forecasting are predicting the yen/dollar to hit 125-135 in the time period Nikon is forecasting 100. No one else is forecasting 100.

Nikon used to micromanage the currency exchange forecast number, now they’re just sitting on an old, out-of-date value. This is a bit disingenuous for a company that exports most of its products. As their own presentation points out, the financial impact on operating profits for a 1 yen deviation from 100 is 0.2billion yen. If the yen ends at 125 to the dollar, that represents a potential increase of up to 5b yen in income. In essence, Nikon is putting in some padding room for their numbers. By forecasting 100 yen to the dollar in an environment where that number is long past, their profit estimates will be easier to hit.

The bottom line is still the same, though: how does Nikon grow? Cameras are 74% of Nikon’s sales in the first half of this year, after all, and the camera market is shrinking.

For the time being, Nikon is keeping sales numbers artificially up by selling more high value cameras than low (a reversal of a previous pattern), but if the camera market continues to decline in volume, that’s just scrambling to keep your head above water, not making progress towards shore.

We’ve seen this scenario before: a company with good financial performance that finds its products have matured into a state where growth is no longer easily obtainable. When that happens, there are only a few ways things go next. Nikon publicly says acquiring medical businesses will be their growth opportunity. That’s the “diversify” model. What I and other Nikon camera users want to see is the “reinvent” model: find the problem that’s holding back photographic equipment sales and solve it before a competitor does.

JPMorgan’s private report on Nikon’s recent earnings report had the following words in it: "We see a need for a bold change of strategy, for example at the imaging segment by introducing a full lineup of sensor sizes including for mirrorless cameras, and without lagging behind Sony.” As one of the people I correspond with on the economic side puts it, seeing words in print like this is dangerous for Nikon: Nikon is starting to be perceived as a follower, not a leader, and in their primary market (remember 73% of their sales). That needs to change, ASAP.

It’s that last paragraph that’s key: even fan boys should want Nikon to lead again. What Nikon’s “led” with in the recent past is a random selection of very good, yet somewhat overlapping and confusing array of FX camera bodies. In this sense, Nikon appears to be trying to say “let’s go back to the future" (full frame SLRs). Simply put, not everyone is going to buy that leadership. Indeed, as I’ve pointed out with the leaking articles, there’s significant customer erosion being caused by Nikon’s current leadership method.

I’ll conclude with one good piece of news that’s related: Nikon's inventories of cameras has come down. That means that should they have some new and exciting products in the wings, they won’t be fighting quite so much with themselves to unload older products.