(news & commentary) updated

I delayed reporting this because I wanted to ponder the details and get some distance from Nikon’s positive spins before I wrote anything.

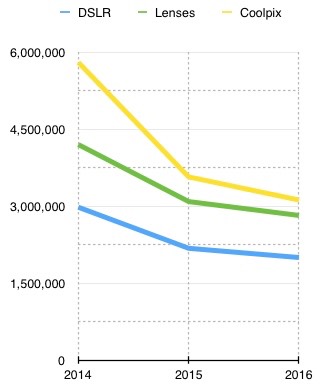

Nikon on Friday reported their second quarter fiscal results. Nikon’s top line is that sales and operating income increased year on year (5 and 11% respectively). I had to actually go back and look at last year’s second quarter to get a perspective on that. Last year’s second quarter wasn’t exactly a strong one. Indeed, let’s look at the unit volumes for the first half of the last three fiscal years (the current fiscal year for Nikon is labeled 2016, as it ends in 2016):

Yeah, big drop last year, smaller drop this year. In everything they do image-wise. Here’s the thing: every number Nikon reported for the first half of the year in the Imaging business was down except for one: operating income. I’ll let Nikon’s words speak here: “Sales stayed at the same level [sic] and operating income was lifted by product mix improvement and cost reduction measures from the last forecast.” Apparently -1.4% to Nikon is “same level.” And even then note the “from the last forecast,” which was just a couple of months ago. In reality, sales are down 13.8% from last year and operating income is down 3.3%. It’s only from their last forecast a couple of months ago that Nikon can claim any improvement.

Meanwhile, inventories are up a bit from this time last year (at least in the Imaging business).

For the full year, Nikon expects the imaging group to drop 8.7% in sales and 17% in profit from last year. Nikon’s positive spin on that is that their estimate has been revised upward.

I read on some other Internet site that Nikon was now predicting higher unit volumes in the second half of their fiscal year. Not quite right. They were always predicting higher volumes, but now they’ve revised the Coolpix numbers slightly downward and the lens numbers slightly upward. DSLR unit volume is expected to remain the same as their last prediction.

If Nikon makes their estimates (a big if), here’s what that means (Nikon’s estimates against current CIPA estimates):

- 33.9% market share in ILC (DSLR/mirrorless)

- 29.1% market share in lenses

- 32.3% market share in compact cameras

update: it was pointed out to me that the above were Nikon’s estimates for the year against CIPA’s estimates for the year, but we could actually compare actuals directly. Things work out far worse for Nikon when we do that:

- 28.2% market share in ILC (DSLR/mirrorless)

- 24.7% market share in lenses

- 26.2% market share in compact cameras

Bottom line: for Nikon to get to the market shares they’re predicting for the full year, they’re going to have to have a big pick upon the October through March period.

The reason I wanted to think about the financial results a bit before reporting them is this: what the heck is Nikon managing to? From all appearances, Nikon seems to be managing to keeping a constant market share in ILC and lenses while squeezing more profit per unit out. As one poster on an Internet forum put it, Nikon is managing to short term investor requirements and not to customer needs.

Cutting costs is a reactive measure, and it’s reactive within the organization, not reactive to customers. No doubt an organization as large as Nikon has bureaucracy and bloat that can be cut, but I actually don’t see them doing anything to reduce that (e.g. no top management pruning nor level of reporting reduction). What I see is that Nikon is taking costs out of product, QA, marketing, and distribution, all of which can and do have impacts on customers.

Nikon financial reports give Nikon customers no relief from the things that they’ve been encountering. Customer support and service is thinner than it has ever been. Some products aren’t reliably in inventory when a customer might actually want to purchase them. Quality control has produced repeated recalls on high-end products. Indeed, I’m starting to believe that if I could actually follow every cost cutting measure that Nikon has performed, I could trace that directly and immediately to a customer problem that then surfaced.

No, Nikon is not in financial trouble (at least if they aren’t hiding some big secret in their financials as a number of other Japanese companies have been caught doing lately). They’re in existential trouble. Their corporate philosophy statement contains the following aspiration: “Meeting needs. Exceeding expectations.” Indeed, the first two sub-components of that look like they’re not exactly being met: “providing customers with new value that exceeds their expectations” and “sustaining growth through a break with the past…”

Nikon is a top-down, management-by-consensus company. That means that change not only has to come from the top, but it has to be ratified by all at the top. As Nikon customers, I think it’s time that we demand that a change in attitude towards us is long overdue and is necessary by Nikon management. I suspect that without such change, what we’re going to see in Nikon’s Imaging business is the same thing that happened to Nikon’s Precision semiconductor business: eventual stagnation and marginalization.

Oh, and Nikon’s nascent medical business? Losing almost half the dollars it takes in sales.