(commentary)

One thing hidden in plain sight is that cameras are doing different things in various regions of the world. The whole “mirrorless versus DSLR” battle is taking place on differing fronts with dissimilar results. Canon’s recent comments during their fiscal year report clearly indicate that the camera companies are aware of this regionality issue.

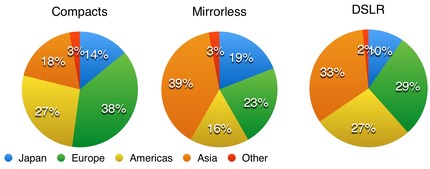

Let’s look at the CIPA data for 2015 (through November) in graph form for camera type by region:

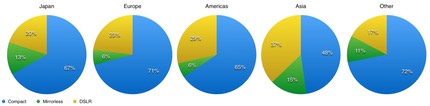

Or another view, camera type within regions:

See the clear differences? Europe and the Americas tend towards higher DSLR percentages and lower mirrorless numbers.

Worldwide mirrorless has risen overall to one for every three DSLRs sold, but not in Europe and the Americas, where the number is one mirrorless for every four DSLRs sold. Hmm. Sure enough, in Japan and Asia it’s almost one mirrorless for every two DSLRs.

It’s important not to put your own view of the world on various camera models that get introduced. The whole mirrorless versus DSLR has a clear regional component to it. For example, Fujifilm recently revealed that the X-A2 sells quite well in SE Asia, but not at all well in the US. We can chalk that up to only one of two possible (big) things: (1) better marketing in a region; or (2) regional preferences. I think it’s #2, which then drives #1.

In an interview with dpreview, Fujifilm’s Toshihisa Iida said: “Asian consumers care more about [smaller] size but for Americans the quality and performance are the priorities.”

So what’s this mean for Canon and Nikon, the duopoly in cameras, or Canon/Nikon/Sony, the overwhelming triopoly?

Obviously, with their strong emphasis on DSLRs, Canon and Nikon need to watch out or become more regional towards Europe and the Americas. Sony, with its fast dwindling DSLR reliance, is likely to make more inroads mostly outside those two big markets. Companies such as Fujifilm, Olympus, and Panasonic are truly dependent mostly on Asia at the moment.

The problem for the mirrorless companies, of course, is that Europe and the Americas require a big infrastructure to support. Breaking down the established conventions and preferences towards DSLRs in these markets is costly, as Samsung recently discovered. But another problem is this: economically, almost everyone is predicting strength in the US for 2016, recovery in Europe for 2016, and serious economic malaise or worse for the rest of the world, including China. Factor in the regionalization of cameras, and you get yet another problem to deal with if you’re a camera maker.

Which brings me to a statement: regionalization impacts are yet another volume issue for camera makers to deal with. Overall, unit shipments are seriously on the decline, and especially at the two extremes, compact cameras and to a lesser extent DSLRs. But regionalization puts even more trickiness into those declines. Regionally, some declines make for really troubling volume situations.

I’ve mentioned it before, but I’ll do so again: the camera business hasn’t hit bottom yet. Not even close. Having a few regional “wins” sounds good, but the truth of the matter is that the number of dollars being spent on traditional cameras is still declining overall and causing big stress issues on every company.

The question now is when those declines become high enough to begin killing off the infrastructure in ways that create snowball effects. Pentax, for example, has very little dealer presence now in the US. Hard to recover from that. But as overall camera sales go down, we’re going to see more outlets for cameras shrinking or closing. That has a circuitous impact on sales volume: fewer outlets equals fewer sales equals fewer outlets equals fewer sales, ad infinitum.

Sadly, there’s not much you personally can do about this. Basically:

- Support your local camera dealer when you can.

- Don’t put off upgrades too long.

My assessment is that we’re deep into the same type of collapse that HiFi gear went through. Yes, we’ll still have such gear in the future. No, the market for it won’t be anything like it was. Your choices will likely all be higher priced and more geeky. The places you can find such gear will be fewer. Plus companies you’ve been relying upon may disappear or at least shrink.

Please don’t shoot the messenger. I’ve written for a long time that the camera makers needed to rethink their product. For the most part, they still haven’t yet figured out how dedicated cameras live in a connected world, let alone perfected that. Until (and unless) they do, the message is going to pretty much continue to be a dismal one.

Yes, Nikon’s use of Bluetooth for Snapbridge on the D500 has some interesting intersection with that previous sentence. But the problem isn’t just enabling another wireless connection, it’s the software that works via that connection that will determine whether Nikon has broken the code and found the right solution to begin turning things around a bit.