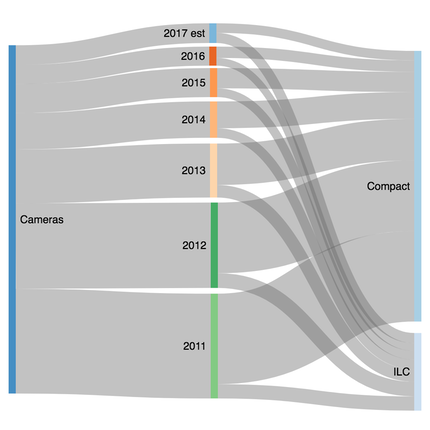

Let's look at camera unit volume in a different way today. Here are seven year's worth of CIPA shipment data put into Sankey Diagram format:

That puts everything into an interesting perspective, doesn't it?

While compact cameras have traditionally been the big volume mover for the Japanese camera companies in the digital era, look at how that shrank from 2011 to 2017. The majority of the manufacturing and corporate infrastructure to support all those compact camera sales that was built up in the first decade of the century has now been dismantled, reconfigured, mothballed, or sold off, or it will be soon at companies still clinging to that market.

You'll note that the entire seven years of ILC volume in this chart amounts to less than the 2011 compact camera volume. Eek.

Rarely do industries collapse this dramatically, this fast.

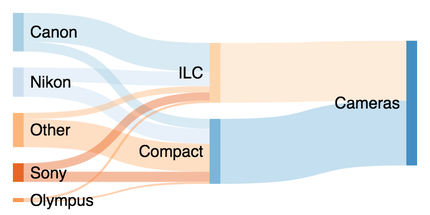

If you want a view of what the current market shares look like in Sankey form, here's a graph from the best public data I have for the past 12 months (trailing year numbers through June 2017):

Not all the camera companies put out detailed unit volume numbers every quarter, and even some of those that do can be vague at times, or require some additional data sets to flush out completely (e.g. Sony provides overall numbers, but not separate compact/ILC callouts), so you have to derive the camera type information from additional data sources.

Moreover, there are other details that get obscured. Nikon almost certainly puts their KeyMission sales numbers in their compact category reporting. Sony doesn't seem to put their action camera sales in their DSC category, as they consider those video cameras.

The reason that most camera companies don't talk about market share any more has to do with both these charts. First, even Canon retaining nearly half the market isn't exactly a great boast when the market has collapsed, is it? But more importantly, early in the century we had as many as fifteen companies slicing up a big pie. Today we have about nine, but they're sharing a far smaller pie. Every pie piece is smaller, even having lost a few competitors.

Basically the camera maker's primary goal these days is existential: continue to exist. It used to be that you could try to be a big fish in the big pond, or try to build a smaller pond you could be a big fish in. But water is scarce now. Everyone is in the small pond, big fish and small.

This year (2017) the camera makers are desperately trying to put more water in the pond. Well, that's not accurate to the analogy, try this: they're building more fish in hopes the pond gets and stays larger. The results of that won't be known until after the holiday buying season ends.

My suspicion at this point is that this is going to be a Christmas filled with rebates and sales. In other words, all that optimism the Japanese companies seem to have about 2017 being better than 2016 is going to get a strong dose of force feeding to make it come true. Come their financial presentations in early 2018 everyone in Tokyo wants to be saying "the bottom was reached and we're growing again."

Are they? Will they? And even if they are, how fragile is that growth and can it sustain an economic or other crisis?

Nervous times in Tokyo these days. Cautiously optimistic, but the hands are still shaking under the table...