Nikon last night reported their financial results from the April through June quarter, the first quarter of Nikon's current fiscal year. As I would expect, there weren't really any big surprises in the data, as Nikon recently did a big set of presentations on their previous fiscal year and their predictions for the current one. Any big change would have likely been an unwelcome one, so no change is good news.

But the news isn't great. We're still in the same scenario with the Imaging Products Business, where all the camera and lens activity occurs: slowly declining revenue, with a mad scramble to try to keep operating profit up (e.g. cut costs).

Surprisingly, Nikon sold a few additional ILC units in the quarter compared to last year (720,000 versus 710,000). Nikon indicated that this was partly due to increased "marketing" in the US, which I take to mean the discounting they've been doing. Likewise, lens sales were slightly up year-to-year. Compact camera sales were down by 8%, overall revenue down by 3.7%, and profit down by 24.7%.

So the story isn't changing.

For the full fiscal year Nikon is predicting Imaging sales down 10% and profits up 9.9%. They're predicting a 23.6% market share in ILC (DSLR and mirrorless), a 20.5% market share in lenses, and a 22% market share in compacts.

Reading between the tea leaves in Nikon's statements, we won't be getting a new mirrorless system before April 2018: the unit forecasts just don't support anything but more of the same DSLR iteration. What you can see in the forecast is the D850 ;~). Revenue and unit volume down but profit up. As the Japanese companies like to say, "shift focus to high value-add products."

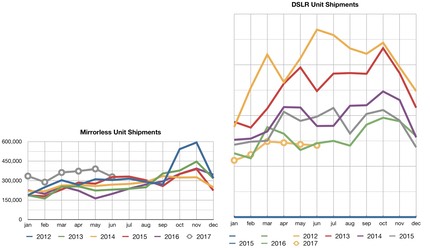

Meanwhile, news in the rest of the camera industry is a bit less bleak. Here's the first half numbers for ILC units:

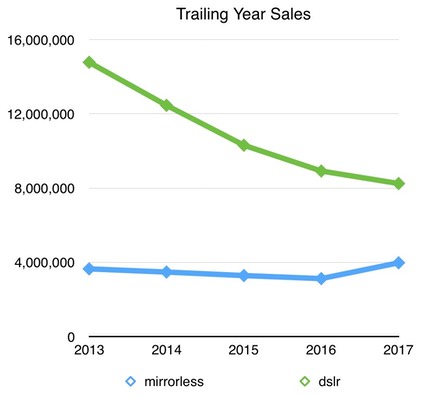

Personally, I've started using trailing year as a better indicator of where we are, and here's that graphed:

Mirrorless is having its best year ever (at least since CIPA has tracked it as a separate category). Meanwhile, DSLRs are only down about 5% this year. But there are other little telltale signs in the numbers. Mirrorless dollar value has been going up, too, while DSLR dollar values have been going down. Mirrorless is now up to a bit more than one-third the ILC category at 36.2% of units. We also may have the first year of increased ILC unit volume since 2012, though that will depend a lot upon how the second half of the year shapes up.

Now put the two things together: Nikon financials and CIPA information. Nikon's market share is down 10 points from its traditional spot in ILC. Mirrorless has gone from 20% of the ILC market five years ago to 36% now. Nikon doesn't have a viable mirrorless system (Canon does, which is probably why it isn't losing market share). Simple conclusion: Nikon management fumbled, big time.

The good news is that the game isn't nearly over. At current trends, a solid Nikon mirrorless system introduced by Photokina 2018 should turn market share back towards Nikon some. But not as much as it would have if they had been as quick as Canon to address mirrorless seriously. For a company that gets 53.4% of its revenue from cameras, you'd think that they'd be a bit better at understanding where they need to be in the camera market.