It's that time of year again. The Japanese camera companies are all wrapping up their fiscal years (other than Canon, who's in their first fiscal quarter), and CIPA has published their deeper look at the industry numbers for 2018 as well as their forecast for 2019.

First, the CIPA January shipment numbers are also out, and as other sites have noted, they don't look good.

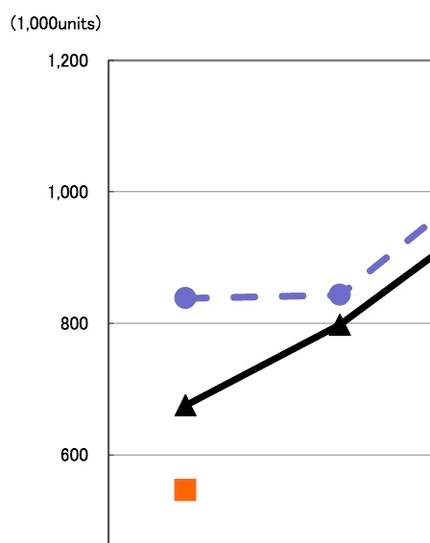

ILC January shipment numbers worldwide: blue is 2017, black is 2018, orange is 2019. In numeric form, if 2017 is 100%, then 2018 was 80.6% of that, and 2019 was 80.9% of 2018. The killer number, though, is that the 2019 value (sales dollars) for mirrorless was 112% of 2018, while DSLR was 61.3%.

The problem with the way everyone is analyzing those results is problematic, though. Shipment numbers tend to be moved by new products, not older products. There were no DSLRs introduced in the last quarter of 2018 or the first month of 2019. Looking backwards, we have the D3500 in August, and the Pentax K1m2, Canon Rebel T7 and 4000D in March. Not exactly a prolific year for DSLRs, thus it's completely understandable that their numbers are down. Moreover, virtually all of the new DSLRs in 2018 were entry models, which means value (sales dollars) would go down.

Meanwhile, in the mirrorless world, a different thing was happening: in the last four months of 2018 we had five new mirrorless camera introductions, but the lowest of them was the Fujifilm X-T3 (the others were the Nikon Z6 and Z7, the Canon R, and the Fujifilm GFX50R, all relatively expensive cameras). This shows in the numbers: shipment volume down, shipment value up.

I'm often amused at CIPA's statistical summaries. For instance, in page 7 of their year end analysis they claim that the market size value for cameras has more than doubled since the film peak in 1991 (it went up 120% to be more precise). Unfortunately, inflation alone would produce an 86% increase. Which means that over the course of 27 years, market value has really only averaged a small single digit of growth a year (though there was a huge spike in the middle, when digital went supernova).

On that same chart, they also don't call out that since that spike around 2008, the camera market size has shrunk by more than half ;~). Again, not counting for inflation.

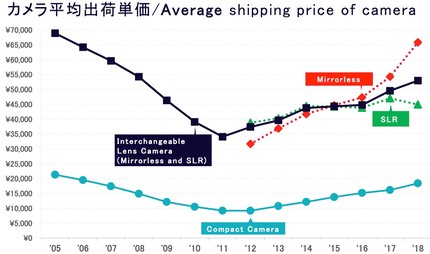

The more telling chart is the next one, though:

Remember what I wrote above about the January numbers that look so bad: mirrorless volume was down, but value was up. That might be distorted a bit in the coming months by the introduction of the Canon RP, but we also have plenty of higher end mirrorless gear that was introduced recently, too (Olympus E-M1X, Panasonic S1 and S1R), so we may continue to see it tick up.

This is a trend the Japanese companies hope will continue, but I don't think will. Certainly not on the rising curve seen in the above graph, as it's unsustainable. The current high-end mirrorless cameras are all so good that they encourage Last Camera Syndrome from the user base (i.e. no incentive to upgrade once they have a really capable camera).

There are two groups that aren't being fully catered to in mirrorless at the moment: the 1DXm2 and D5 users (super high end, but very few in number), and the entry full frame (the D610 and 6Dm2 users, though the RP now addresses the latter). Picking up those users is going to be important to Canon and Nikon, the two industry leaders.

CIPA tries to make the claim that users want new lenses more than they used to ("almost triple" [the unit volume] from the film peak in 1990 to 2018). Unfortunately, their very next slide kills that idea: the number of lenses sold per camera body has remained pretty consistently around 1.6x during the digital era. What has happened, though, is that the average selling prices of lenses has gone up, and particularly for full frame.

The question is whether we have a chicken or an egg or a manipulated fowl market. Is it really because users want more expensive mirrorless cameras and full frame lenses that that's what we're getting? Or is it because the Japanese companies saw a way to push revenue and gross profit margin with some clever marketing that induced a modest buying boost? It's probably both things in combination, but with more push than pull. (Push is company marketing, pull is user demand.)

A bit further down we see another set of charts that illustrate this. 62% of ILC volume is DSLR, 38% is mirrorless. 52% of ILC sales value was DSLR, 48% was mirrorless. In Asia, mirrorless now outsells DSLR. Europe and the Americas are the laggards still getting DSLRs.

CIPA's report comes out right after they've polled their members on likely future shipments (e.g. what will happen in 2019). Those numbers are: 20.7% fewer compact cameras, 7.4% fewer ILC, and 8.3% fewer lenses in 2019. To put numbers on those: 6.9m compacts, 10m ILC, 16.5m lenses.

The ponds are getting smaller, and everyone is now in the pond that's likely to be the primary one (mirrorless).

I'm personally more pessimistic. The camera makers are going to be hard-pressed to make those forecast numbers without discounting. Tangible discounting hurts the products that are already the weakest (e.g. crop cameras), which compounds the problem. Companies like Nikon are also being pressed to make their already existing cameras (Z6 and Z7) better through firmware changes, rather than introducing new ones.

I still believe we're going to go down to at least 8m ILC in the near future. Whether that's 2020 or 2021 or 2022, I'm not sure. The Japanese companies can and do game the system at times using pricing and other techniques such as keeping older models on the market longer, channel stuffing, and attempts at getting growth from countries like India and the other BRICs. They're trying to micromanage what has to be a terrible environment for them. I'm on record as saying that some companies are getting this wrong (e.g. Olympus with the E-M1X, which runs counter to the marketing message that got them established and which led to their 4% market share base).

Canon wants 50% of the pond. The pond is getting smaller. Nikon wants at least 20% of the deeper end of the pond. Sony wants more of the pond. Those three companies account for 85-90% of the entire pond, yet the pond keeps on shrinking.

This is usually where I say "there will be sales." Yes, I believe so, and festering world economy issues will potentially increase that likelihood. But the camera companies are going to do everything they can to resist those sales. The sales might be briefer, they might rotate through models rather than being across the board, or they might be more of the bundle variety (e.g. Nikon's get a vertical grip for free type). With the continued contraction of the camera market, every dollar retained is going to be important for the long-term viability of the Japanese camera companies.