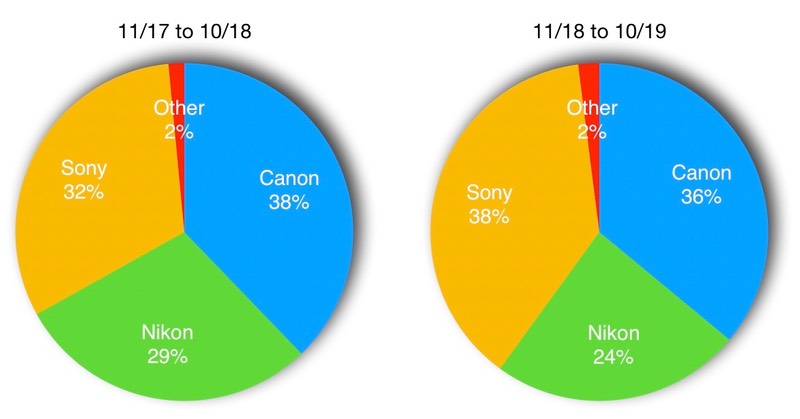

We’re coming up on that time of year when some early sales statistics are thrown out, generally in support of some contention. BCN—a company that tracks a large chunk of retail sales in the Japan home market—has this habit of being controversial in this respect, each year putting out near year-end charts that tend to rile up the “any number is good is along as it supports my bias” crowd.

Let’s see if I can get out ahead of what will be the latest claims flying around the Internet. Here’s the summary information from BCN rounded to the nearest percent that shows how full frame cameras are doing (both DSLR and mirrorless):

Again, this is in Japan only, and with a slightly non-representative store sampling that can be gamed by manufacturers.

There’s little doubt that Sony has gained market share in full frame (not just in Japan; my US market figures show a closer three-way race, but similar).

Let me share the first headline I saw citing this information: "BCN reports that Canon and Nikon have lost their full-size war agaist [sic] Sony this year.” If by lost they mean Sony and Canon switched positions but are still close and that Nikon lost some market share, sure. But note something: this is definitely a three horse race, and has been for awhile. Canikony is dominating full frame camera sales (~98% of market) in Japan and elsewhere. This is not news.

As I’ve pointed out previously, a lot of Canon and Nikon enthusiast/pro shooters are in a wait and see pattern at the moment, as neither company has quite produced the product that will motivate significant upgrades, let alone a stampede. In Nikon’s case, they aimed a little lower than their top DSLRs with mirrorless and still have a lens catch-up situation to fix. In Canon’s case, they aimed really low with full frame mirrorless bodies but really high with full frame mirrorless lenses, which has people scratching their heads waiting to see what the real mix will look like. Sony, meanwhile, has a pretty full lineup of updated bodies and a rather complete set of lenses now, and is more on cruise control at the moment.

Put another way, for full frame:

- If you’re considering Canon, you’re not sure what’s happening with camera bodies. How long will Canon DSLRs stay relevant and updated, and what will the mirrorless enthusiast and pro mirrorless bodies really be like?

- If you’re considering Nikon, you’re slightly underwhelmed by the Z7 versus D850, though the lenses so far intrigue you in how good they are. Dissonances like that are not good for creating sales. Meanwhile, DSLR updates other than the D6 seem to have stalled.

- If you’re considering Sony, you pretty much know what is and will be available, and you can make that decision with reasonable confidence today. Couple that with broad third party lens support, and things look good in the FE mount.

So it’s not surprising to me to see Sony gaining in full frame. Canon and Nikon are in the midst of a transition, and they haven’t handled it particularly well, let alone perfectly. They’re big companies with plenty of analytical and engineering prowess, though, so they’ll figure things out.

The usual conclusion I see from stats like those that BCN posted tends to be something more like Sony will continue to gain and eventually completely dominate what remains of that market. I’d caution people to avoid that type of naive conclusion.

Certainly if Canon and Nikon continue to fumble the ball in their transitions they will continue to lose momentum. But if they slowly pull their acts together, there’s a huge base of Canon EF and Nikon F users that have not transitioned to a more modern camera. If both companies hold their faithful, things will almost certainly stay as they have for several years: three companies dominating full frame camera sales, each with at least 25% of the market, none with more than 45% of the market. I call that a triopoly.

If you’re one of those saying that Olympus should just introduce a full frame mirrorless camera, you should be able to see now that ship has sailed. They stand no chance. One has to wonder what Panasonic was thinking.

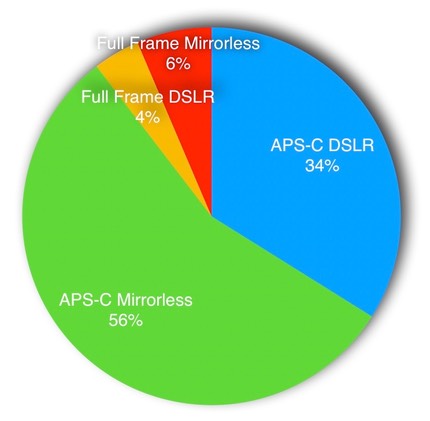

Meanwhile, another stat was published in that BCN article that’s about to get so much attention: the ratio of full frame to APS-C sales in Japan. For DSLRs and mirrorless together, that works out to 10.4% full frame, 89.6% APS-C.

Every time I point out that you need to make APS-C cameras (or other crop sensor sizes) to survive, people jump on me from all parts of the Interwebs. Consider the following chart for the last twelve months in Japan, according to BCN:

Note that Japan is a majority mirrorless country these days. That does not apply globally. The US market, for example, is still DSLR driven, though this is slowly changing.

That’s far worse than my Market Bottom projections in the slant towards smaller sensor ILC, yet people still claim I’m underestimating full frame’s sales. No, dear reader, I’m not. I’m predicting further market contraction, and most of that contraction is going to occur in smaller sensor cameras. Otherwise, my full frame projection would be even worse than it was.

What BCN didn’t say in their statistics post is this: in the two one-year periods they reported, ILC unit volume in Japan dropped almost 19%. I don’t have enough information to say specifically that was more in APS-C than full frame, but that’s my suspicion based upon the numbers I can see.

If you’re into full frame, I think you’re fine no matter what brand choice you make (at least for the foreseeable future). You’ve got three strong companies fighting hard over a smallish, but profitable user base. That’s going to continue for some time, and competition like that is good for all of us, no matter which mount we choose (EF, F, FE, RF, or Z). Nikon seems to have a clear transition plan now, and Canon will figure it out. Sony reaps short term benefits by already being there (and everyone seems to forget when they were losing market share when they were making their own transition from DSLR to mirrorless).

APS-C, however, is another question. Canon and Nikon still have piles of consumer APS-C DSLRs they need to unload, which is a double-edged sword, as they’ll have to unload them via lower pricing, and lower pricing establishes new price points they will have to meet in the future.

I’m still a naysayer about Canon’s APS-C plans going forward. EOS M just seems like a dead end because it doesn’t lead to RF and Canon’s doing the “no lenses” thing I’ve been rallying against for years now. Which is a shame, because the new sensor in the M6 m2 looks really good, and more good lenses would make it really shine. I strongly suspect that internal fights are crippling what EOS M could have been or will be.

Nikon, on the other hand, has a winner in the Z50. Not a perfect camera, to be sure, but it fits squarely with their full frame mirrorless strategy, so much so that moving my shooting between a Z50 and Z6 in a session is actually a little less jarring than moving between a D7500 and D750. Nikon needs a lot more product in APS-C to be competitive, but they’ve put a nice strong marker in the territory.

Despite all that, we’re going to see lots of “Sony Wins” articles and posts shortly. In Japan. In a subset of stores. By a small margin.

I’m not sure how that’s supposed to change your thinking about what to buy, but that seems to be the implication of many of those articles/posts. Make rational decisions for you, don't waste time becoming a partisan brand advocate trying to convince others to do what you did (or might do). Even if you believe that there’s “safety in numbers,” the numbers currently say you’re safe buying into Canikony full frame.