As always, there are gems galore in Nikon’s Annual Report. Nikon, while opaque on many levels, is actually relatively transparent when it comes to public information. As usual, I’m a little late to getting around to noting those gems.

Let’s start with the big picture. Simply put, it’s “Precision will get us through the 2017 Fiscal Year.” [Reminder: Nikon’s fiscal years end March 31st of the named year, so we’re currently in the 2017 Fiscal Year as I write this.]

In numbers that’s:

- Precision

- 2015 171b actual

- 2016 182b actual

- 2017 260b estimate (bump)

- 2018 210b estimate

- Imaging

- 2015 586b actual

- 2016 520b actual

- 2017 440b estimate (dip)

- 2018 570b estimate

Note the dip in Imaging that corresponds to the bump in Precision. The total between the two doesn’t vary by more than 10% over a four year period, which smacks of managing to numbers.

Further examination tells us that Nikon really expects “growth” to come from Instruments (55% growth in three years) and Medical (174%, ditto). Other also grows substantially (64%) in that same period.

There’s nothing wrong with trying to diversity Nikon’s business. As I’ve written for some time, this is overdue and late. But here’s the thing that a lot of the analysts covering Nikon keep missing: even using Nikon’s estimates of substantive growth in those new businesses, at the end of its current future projections Nikon is still 58% reliant on cameras for its sales, and 85% reliant on cameras for its operating income. As go cameras, so goes Nikon. True in the past decade, still true as far forward as Nikon cares to project.

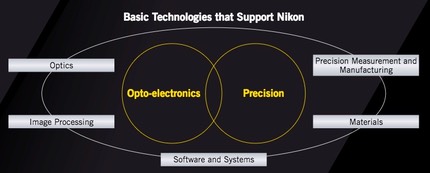

And yet, the primary internal assessment and assertion is that Nikon is an “opto-electronics and precision technology” leader. Indeed, they go so far as to use the following illustration:

As much as the Annual Report tries to set Nikon up as a precision instruments and machine business, the numbers still say it mostly sells cameras and lenses to consumers. So I’m going to mostly concentrate on things that were in the Annual Report that deal with the Imaging group. [Bold/Italic is a quote from the report. Normal text is my commentary]

- “With regard to the D500 launch postponement, the problem was that we were unable to grasp adequately the level of demand.” OMG. Year after year I survey large population of Nikon users that come to my site, and they’re right in the sweet spot of the D500. Year after year I noted that the demand for a D300s replacement was large, maybe even Yuge, to use a term popularized by media mocking one of our presidential candidates. How is it that I could see this demand—and even wrote publicly how large it was a number of times not only on my site but on other forums on the Internet—and Nikon couldn’t? Sad. Really, really sad.

- “...we have been collecting and consolidating sales performance data accumulated over the past 10 years. In addition, we are promoting initiatives that will encourage customers’ willingness to make a purchase. Not only supplying information on new products as previously, we will carry out more active approaches, such as recommending by customer the most suitable lens and accessories in conjunction with new products.” This is a repeat from a previous report, and it’s hilarious. I used to get emails from NikonUSA about products that should be of interest to me, but I haven’t gotten one for quite some time. I’m trying to remember the last time I got an NPS email, too, and it seems like that was a long time ago, too. I’d also say that when Nikon was actively emailing me, the marketing message was usually off-target, too. It was mostly “hey we’re selling this now.” It wasn’t “we know you have an X and this new Y will help you in the following ways, so why not upgrade?”

- “...the suppliers of parts for a wide range of Nikon products, including [mirrorless, DSLR] and compact digital cameras, were affected by the 2016 Kumamoto Earthquake, which has hampered production and sales. Giving priority to the manufacturing of highly profitable middle and high-end digital SLR cameras, we will focus on recovering from that situation.” This is much as we expected: with sensor and other parts supply falling short of what Nikon needs, they are putting most of their efforts where they make the most profit. Sony did the same thing.

- "While compensating through M&As and alliances for those fields in which Nikon’s technologies will not be sufficient, if we were able to top up with value-added products and businesses, it would probably become a notably different Imaging Business Unit to what it has been up to now. Breaking out of our current shell, we will aim to make a fresh start, united as one, in an Imaging Business Unit that boldly faces challenges.” Multiple things to note here. This particular statement preceded the acquisition of camera robotic maker Mark Roberts Motion Control. It’s clear that Nikon was already working on acquisitions like this when the Annual Report was written, and I’m pretty sure it won’t be the last one we see. Note that this is different than the investments that Nikon is making through their venture group. But “notably different Imaging Business Unit”? That needs a a lot more explanation, which is completely missing both in the report and any other interviews or press announcements to date. Personally, I’d like to know a lot more about that.

- “...sales of the expected mainstay digital SLR cameras were weak, for example in the year-end shopping season of each country. Furthermore, the sales of other models were unable to cover the effects of delaying the launch of the new D500 model, resulting in a 19% decline in operating income.” Again, a couple of things to comment on. First, weak sales of DSLRs in every country during the key selling season seems like a pretty substantive wake up call. That needs to be fixed. Unfortunately, the Kumamoto quake may have made that more difficult than it should be, as the only truly new DSLR product coming into that season this year is the D3400, which isn’t really much different than the D3300 that didn’t sell that well last year. And again we get mention of the D500 launch delay, but here Nikon is implying that the D500 delay by itself resulted in a 19% decline in income. I don’t think so. Something tells me that the English translation—and maybe even the original Japanese statement—didn’t quite get this right. Weak Christmas sales coupled with the delayed launch of a critical model certainly would combine to make a 19% decline, don’t you think? Because if a single model that would have only sold maybe 30,000 units in the fiscal year creates a 19% decline in income, then things are much more terrible in the group than we know.

- "Although there are uncertainties, the Imaging Products Business plans to have recovered, including its full production system of its mainstay digital SLR, in the second half of the fiscal year, and I would like to minimize the extent of the decrease in profit over the full year.” This is in response to the earthquake, which damaged the supply chain. Nikon seems confident that they can resume sales levels to those of the past once sensor and other parts supplies restart in the second half (which started October 1, 2016). And it comes from middle and high-end DSLRs if we’re to believe other statements in the Annual Report.

- "Sales of entry-class models such as the D5500 were strong in Japan. Contrastingly, in China and Europe, sales growth was recorded in middle and high-end digital SLR cameras, such as the D750.” Hmm. D5500, but not D3300? What’s that tell us about Nikon’s real entry-level product in their home market? So why was the D3400 update so lame?

- "The expectations are that we will be able to achieve the target for reducing procurement costs, centered on the Imaging Products Business, of ¥30 billion over the three years from the fiscal year ended March 31, 2015, to the end of March 2017. Among others, the effect of the cost reductions in the Imaging Products Business has been significant, and we are addressing on an ongoing basis the upstream cost reductions, referred to as a “Design to Cost,” in the development and design stages. If we can reduce the lead time from development to sales, we will be able to not only reduce initial costs but also to aim for synergistic effects, such as well-timed market entries.” All kinds of things to write about here, but the one that stands out is the Design to Cost bit. See my other article I posted today. De-contenting, which is what Design to Cost tends to do, is not the solution that’s necessary to reverse camera sales declines. I’ve publicly said that for a decade—back when I was first predicting peak sales, then later when the peak was reached and we headed downhill—and I still believe I’m right.

- "Due to falls in resource prices in recent years, the economic situation in Russia, Brazil, Indonesia, and other countries where growth is expected has been unfavorable, and growth in the Middle East has come to a standstill. In contrast, there are also countries, such as India, where demand for digital SLR cameras has increased year on year, so we are prioritizing depending on the region. We are reviewing and planning to optimize out initiatives in both the large-scale European and U.S. markets and in emerging economies.” The entire camera industry knew that they had tough times trying to continue to grow at the pace they were growing in the first decade of this century. Their solution was a typical one: try to find underserved audiences and target them. That was mostly in emerging and third-world markets, as well as ventures into “cameras for women,” among others. But the responses I see from the Japanese companies have become pretty much boilerplate these days: “it wasn’t our fault, the markets collapsed before we could sell into them.”

One thing that seems problematic to me is this: of the 14 Directors highlighted in the Annual Report, I looked for how many had experience in the Imaging group (as opposed to other parts of the company or external). Being liberal, the number is 3. Of the 20 Officers highlighted in the Annual Report, I believe the number to be 4. So 7 of the 34 highest level managers at the company have significant camera group experience. Does that seem right for a company where over half its sales and most of its income come from Imaging? (By the way, all 34 are Japanese men. Throughout its entire global organization Nikon only has 2 women at subsidiaries in high management levels, and only 35 non-Japanese. Total employment within Nikon is only 10.6% female, though they claim a goal of 25% by 2021.)

Now I know Nikon’s response, because I’ve heard it directly from them before: the established method of promoting CEOs alternatively from the two primary groups in the company has a balancing effect, where neither Precision nor Imaging can ever get so much control within the company that it completely unbalances and goes down one rabbit hole forever. It’s their original diversification effort instantiated.

As I’ve written many times, Nikon is not in any way likely to fail as a company even under the current stresses it faces. There is a reasonable chance that the lower operating income and flattened sales pattern of recent years becomes something they can’t break, and they end up stalled where they’re at. That said, they still have a reasonable ROE, a positive cash flow, a modest debt (most of which isn’t due until after 2021), and an equity ratio that is mid-pack. They’re still paying what for Japan is a decent dividend to shareholders, as well.

In other words, Nikon has the financial health to get through the current weakness in camera sales. However, if the decline in camera sales continues forward for very long and Nikon continues to primarily manage by cost reduction, it will eventually put the company under a great deal of stress. But for now, Nikon clearly has the resources to continue as they see fit.